UFC's Historic $7.7 Billion Move to Paramount+: The End of Pay-Per-View Era and What It Means for MMA Fans

UFC signs a $7.7B media-rights deal with Paramount+, ending pay-per-view and moving all events to streaming starting in 2026.

UFC's Historic $7.7 Billion Move to Paramount+: The End of Pay-Per-View Era and What It Means for MMA Fans

In a seismic shift that will reshape the landscape of mixed martial arts broadcasting, the Ultimate Fighting Championship (UFC) has announced a groundbreaking seven-year, $7.7 billion media rights agreement with Paramount+, effectively ending its relationship with ESPN and marking the death of the traditional pay-per-view model for MMA's premier organization. This historic deal, announced on August 11, 2025, represents not just a change in broadcasting partners, but a fundamental transformation in how fans will access and consume UFC content.

The agreement, which takes effect in 2026, will see all 43 annual UFC events—including the 13 marquee numbered events and 30 Fight Nights—exclusively streamed on Paramount+ with select major fights simulcast on CBS. Perhaps most significantly for fans, this deal eliminates the pay-per-view model that has been a cornerstone of UFC's business strategy since the organization rose to prominence in the mid-1990s.

The Financial Magnitude: A Deal That Dwarfs All Predecessors

The numbers behind this agreement are staggering and represent a quantum leap in the valuation of UFC's media rights. At an average annual value of $1.1 billion over seven years, the Paramount deal more than doubles the value of UFC's previous arrangement with ESPN, which was worth approximately $500 million annually.

To put this in perspective, when UFC first partnered with ESPN in 2019, that deal was considered revolutionary at $1.5 billion over five years. The new Paramount agreement not only surpasses this in total value but also demonstrates the exponential growth in the perceived worth of live sports content in the streaming era.

The deal's structure is particularly noteworthy, with payments weighted toward the latter years of the agreement. This approach suggests confidence from both parties in the continued growth of UFC's audience and the streaming market's expansion. As Mark Shapiro, TKO Group's President and Chief Operating Officer, noted in an interview, the negotiation process was remarkably swift, with the entire deal coming together in just 48 hours following the completion of Skydance's acquisition of Paramount.

Breaking Down the ESPN Era: What Fans Are Leaving Behind

To understand the significance of this transition, it's essential to examine what UFC fans have experienced under the ESPN model. Since 2019, UFC's broadcasting arrangement with Disney's ESPN has required fans to navigate a complex and often expensive viewing ecosystem.

Under the current ESPN+ model, fans must maintain an active subscription to ESPN+ (currently $11.99 per month or $120 annually) and then pay an additional $79.99 for each numbered pay-per-view event. For dedicated UFC followers who watch all 13 annual numbered events, this translates to a staggering annual cost of approximately $1,160—a figure that has increasingly put premium UFC content out of reach for many casual fans.

The ESPN model also created a fragmented viewing experience. While Fight Night events were included with the ESPN+ subscription and occasionally aired on ESPN or ABC, the premium numbered events remained locked behind the additional paywall. This system, while profitable for UFC and ESPN, created barriers to entry that limited the sport's growth potential among younger, more price-conscious demographics.

As TKO's Mark Shapiro bluntly stated, "The pay-per-view model is a thing of the past. What's on pay-per-view anymore? Boxing? Movies on DirecTV? It's an outdated, antiquated model." This sentiment reflects a broader industry recognition that traditional PPV models are increasingly incompatible with modern consumer expectations and streaming consumption patterns.

The Paramount+ Revolution: A New Era of Accessibility

The transition to Paramount+ represents a fundamental reimagining of how premium MMA content will be distributed and consumed. Under the new arrangement, all UFC events—including the previously premium numbered events—will be available to Paramount+ subscribers at no additional cost.

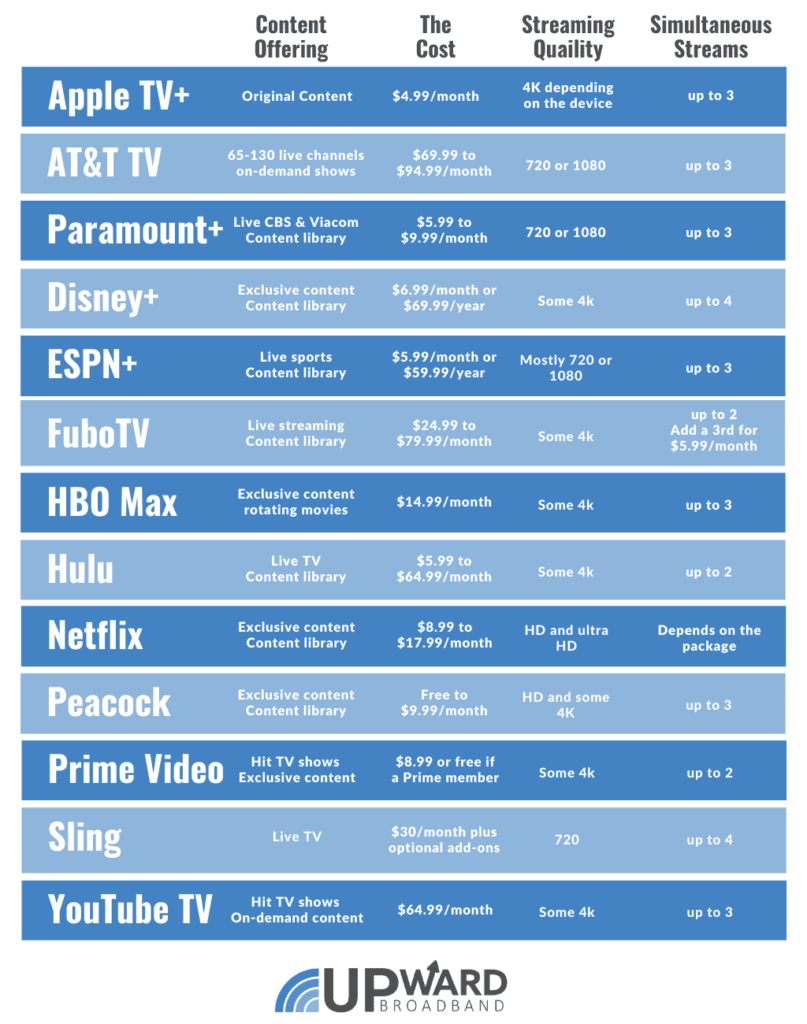

Paramount+ offers two subscription tiers: the Essential plan with advertisements at $7.99 per month ($95.88 annually) and the Premium plan without ads at $12.99 per month ($155.88 annually). Even at the higher Premium tier, UFC fans will save over $1,000 annually compared to the current ESPN+ model—a reduction that could democratize access to premium MMA content and significantly expand the sport's audience.

The deal also includes a strategic broadcast component, with select numbered events simulcast on CBS, Paramount's flagship broadcast network. This element is particularly significant as it provides UFC with access to traditional television audiences who may not yet have embraced streaming platforms, potentially introducing the sport to entirely new demographics.

David Ellison, Paramount's Chairman and CEO, emphasized the strategic importance of this acquisition: "Rarely do opportunities arise to partner on an exclusive basis with a global sports powerhouse like UFC—an organization with extraordinary global recognition, scale, and cultural impact." Ellison, who described himself as a UFC fan, positioned this deal as his first major move following Skydance's acquisition of Paramount, signaling the new leadership's commitment to premium sports content.

The TKO Strategy: Following the WWE Playbook

This UFC-Paramount deal doesn't exist in isolation but rather represents the second major media rights coup for TKO Group Holdings, the parent company that emerged from the 2023 merger of UFC and WWE. Just days before announcing the Paramount agreement, TKO secured a five-year, $1.6 billion deal with ESPN for WWE's premium live events.

This dual-pronged strategy demonstrates TKO's sophisticated approach to maximizing the value of its premium sports entertainment properties. By splitting its major assets between different media partners, TKO has not only maximized revenue but also reduced risk by avoiding over-dependence on a single broadcaster.

The WWE-ESPN deal, while smaller in total value than the UFC-Paramount agreement, established important precedents and likely influenced the negotiations with Paramount. The success of WWE's transition to a streaming-inclusive model provided a roadmap for UFC's even more ambitious move away from traditional pay-per-view.

Ariel Emanuel, TKO's Executive Chair and CEO, framed this strategy in terms of long-term growth: "Our decade-long journey with UFC has been defined by continuous growth and expansion, and this agreement is an important realization of our strategy." This statement suggests that the Paramount deal represents not just a financial windfall but a strategic positioning for future growth in the evolving media landscape.

Fan Benefits: More Than Just Cost Savings

While the dramatic cost reduction represents the most immediately apparent benefit for UFC fans, the implications of the Paramount deal extend far beyond simple economics. The new arrangement promises to transform the entire UFC viewing experience in several key ways.

Simplified Access and Reduced Friction: Under the ESPN model, watching a complete UFC event often required multiple steps—maintaining an ESPN+ subscription, purchasing individual PPV events, and navigating between different platforms for different types of content. The Paramount+ model eliminates this complexity, providing one-stop access to all UFC programming.

Enhanced Discoverability: By including all UFC content within a standard streaming subscription, Paramount+ will likely expose casual viewers to MMA content they might not have otherwise purchased. This increased discoverability could help grow the sport's fanbase and create more engaged, long-term viewers.

Year-Round Engagement: Unlike seasonal sports that experience natural subscription churn, UFC's year-round schedule of 43 annual events provides consistent value to subscribers. This continuous content stream reduces the likelihood of subscription cancellations and creates a more stable viewing relationship.

Broader Demographic Reach: The elimination of pay-per-view barriers is particularly significant for younger demographics who have grown up with subscription-based streaming models. As Mark Shapiro noted, "especially for our younger fans in flyover states. When they find out, 'Wait, if I just sign up for Paramount+ for $12.99 a month, I'm going to automatically get UFC's numbered fights and the rest of the portfolio?' That's a message we want to amplify."

International Expansion Potential: Paramount has expressed interest in acquiring UFC's international rights as they become available on a rolling basis, with approximately one-third available each year. The deal includes a 30-day exclusive negotiating window for each country's rights when they come up for renewal. This could lead to a more unified global viewing experience for UFC fans.

Industry Impact: The Streaming Wars Heat Up

The UFC-Paramount deal represents more than just a business transaction; it's a significant move in the ongoing "streaming wars" as platforms compete for premium live sports content. Live sports have emerged as one of the few content categories that can drive immediate subscriber acquisition and reduce churn, making them increasingly valuable in the competitive streaming landscape.

For Paramount+, which has struggled to compete with streaming giants like Netflix, Disney+, and HBO Max, the UFC acquisition provides a significant differentiator. The platform gains access to 350 hours of live programming annually, along with one of the most passionate and engaged fanbases in sports entertainment.

The timing of this deal is particularly strategic for Paramount. With major sports rights like Formula 1 likely headed to Apple and Major League Baseball not reorganizing its media packages until 2028, premium sports content has become increasingly scarce. As David Ellison noted, "UFC is a unicorn asset that comes up about once a decade."

The deal also reflects broader industry trends toward streaming-first distribution models. Traditional cable and broadcast television continue to lose subscribers, particularly among younger demographics, making streaming platforms the primary battleground for audience attention. By securing exclusive UFC rights, Paramount+ positions itself as a must-have service for a significant and passionate demographic.

Expert Analysis: Industry Reactions and Predictions

The announcement of the UFC-Paramount deal has generated significant commentary from industry experts, media analysts, and sports business professionals. The consensus view suggests this agreement represents a watershed moment not just for UFC but for the broader sports media landscape.

Sports business analysts have particularly noted the deal's implications for the pay-per-view model across combat sports. While boxing continues to rely heavily on PPV revenue, UFC's move away from this model could pressure other combat sports organizations to reconsider their distribution strategies.

The financial terms of the deal have also drawn attention from Wall Street analysts covering both TKO Group Holdings and Paramount. The agreement provides TKO with significant revenue visibility and growth, while giving Paramount a premium content asset that could drive subscriber growth and reduce churn.

Media industry experts have highlighted the deal's potential impact on ESPN's sports streaming strategy. Losing UFC represents a significant blow to ESPN+, which had positioned MMA content as a key differentiator. This loss may force ESPN to pursue other premium sports rights or reconsider its streaming platform strategy.

Challenges and Potential Concerns

While the UFC-Paramount deal offers numerous benefits, it's not without potential challenges and concerns that fans and industry observers should consider.

Platform Transition Challenges: Moving an established fanbase from one platform to another always carries risks. Some ESPN+ subscribers who primarily used the service for UFC content may be reluctant to switch platforms, potentially leading to short-term audience disruption.

Paramount+ Market Position: While Paramount+ has been growing, it still lags behind major streaming competitors in terms of subscriber base and market penetration. UFC fans may need to add another streaming service to their monthly expenses, and Paramount+ will need to prove it can deliver a high-quality viewing experience for live sports.

International Complexity: While Paramount has expressed interest in UFC's international rights, the current patchwork of international broadcasting agreements means the global UFC viewing experience will remain fragmented in the near term. Fans in different countries may continue to face varying access models and pricing structures.

Technical Execution: Live sports streaming presents unique technical challenges, particularly for high-profile events that can generate massive simultaneous viewership. Paramount+ will need to demonstrate it can handle the technical demands of streaming major UFC events without the buffering or quality issues that have plagued some streaming platforms during peak events.

The Broader Context: Sports Media Evolution

The UFC-Paramount deal should be understood within the broader context of rapid evolution in sports media rights and distribution. Traditional models that dominated for decades are being challenged and replaced by streaming-first approaches that prioritize accessibility and subscriber growth over per-event revenue maximization.

This shift reflects changing consumer behavior, particularly among younger demographics who have grown up with subscription-based entertainment models. The success of platforms like Netflix in creating massive global audiences through subscription models has influenced how sports organizations think about content distribution and audience development.

The deal also highlights the increasing value of year-round sports content. Unlike seasonal sports that experience natural viewership fluctuations, UFC's consistent event schedule provides streaming platforms with reliable content that can drive sustained subscriber engagement throughout the year.

Looking Ahead: Implementation and Future Implications

As the UFC prepares for its transition to Paramount+ in 2026, several key factors will determine the success of this historic agreement.

Subscriber Migration: The success of the deal will largely depend on how effectively UFC can migrate its existing fanbase from ESPN+ to Paramount+. This will require coordinated marketing efforts and potentially promotional pricing to ease the transition.

Content Integration: Paramount+ will need to develop UFC-specific features and content beyond just live events. This could include enhanced statistics, fighter profiles, historical content, and interactive features that take advantage of the streaming platform's capabilities.

Global Expansion: The potential for Paramount to acquire UFC's international rights could create a more unified global viewing experience. Success in this area could significantly enhance the value of the partnership for both organizations.

Technology and Innovation: The streaming platform environment allows for innovations in sports viewing that traditional broadcast television cannot match. Features like multiple camera angles, real-time statistics, and interactive content could enhance the UFC viewing experience in ways that weren't possible under the ESPN model.

Conclusion: A New Chapter for MMA

The UFC's $7.7 billion agreement with Paramount+ represents more than just a change in broadcasting partners—it marks a fundamental transformation in how premium mixed martial arts content will be distributed and consumed. By eliminating the pay-per-view model and embracing a streaming-first approach, UFC is positioning itself for sustained growth in an increasingly digital entertainment landscape.

For fans, the benefits are clear and immediate: dramatically reduced costs, simplified access, and the potential for enhanced viewing experiences. The elimination of pay-per-view barriers could democratize access to premium MMA content and significantly expand the sport's audience, particularly among younger demographics who have been priced out of the current model.

For the broader sports media industry, this deal serves as a powerful signal that traditional distribution models are giving way to streaming-first approaches that prioritize accessibility and subscriber growth. Other sports organizations will undoubtedly study the success of this transition as they consider their own media rights strategies.

As UFC President Dana White noted, "This deal places UFC among the biggest sports in the world." With the financial backing of this historic agreement and the potential for dramatically expanded audience reach, UFC appears well-positioned to achieve that ambitious goal.

The transition to Paramount+ beginning in 2026 will mark the end of an era for UFC broadcasting while simultaneously opening a new chapter filled with unprecedented opportunities for growth, innovation, and fan engagement. For MMA enthusiasts around the world, the future of fight viewing has never looked brighter—or more affordable.